In this first article of our ‘operator how-to’ series, we look at optimizing coworking rates with flex data. What is the optimal price for your flex operation? How should rates differ across your inventory types? How are your direct competitors adjusting their pricing? These are some questions which were difficult for flex operators to answer without time-consuming and flawed rate-shopping. Now, with professional coworking data tailored to your market and use case, you can join the growing spaces utilizing comprehensive market data at their fingertips to maximize their revenue.

50 years ago, airlines were working with static prices related to costs or a competitor. The development of data-based revenue management powered a new efficient and effective output of optimal rates, and soon hotels followed the example. Now, the more fragmented short-term rental market is rapidly following this trend, and larger, more competitive coworking spaces are starting to understand and reap the benefits of this level of visibility. And a game-changing benefit is optimizing coworking rates with flex data.

Why optimize rates?

Pricing is very sensitive in any industry, and finding an optimal rate can be challenging. Optimal rate is the price that the right number of your potential coworkers will pay for your desks. To put it simply, if you can identify an optimum price for your desks, you will strike the best balance between desk rate and occupancy - and therefore generate the highest revenue.

Pinpointing that rate hinges on understanding supply and demand. For an accurate understanding of supply and demand related to your flex space, you will need to ensure that you are looking at your true competitive set, to align against those your consumers are choosing between. So, which coworking spaces are in your true competitive set? What do the supply trends look like? How is demand across your set?

How flex rates were selected before coworking data

Without professional data, more manual methods are necessary for getting basic answers to these questions. We spoke with 3 flex operators to understand their methods without data, and moreover, how data has revolutionized their practices and results.

Rate shopping is the most common approach - a process of searching for coworking spaces in your area, and shopping through their sites to understand their pricing. Hopefully you can already see the issues with this method. First, it’s very time-consuming, and can be outdated almost immediately. And then consider the fundamental limitations: with manual rate shopping, you cannot be sure that you are looking at your actual competitive set, so you may be aligning with spaces irrelevant to your consumer demographic. Further, your understanding of their offering will always be limited.

The operators interviewed have seen more efficient and effective processes and results since enhancing their visibility with data. However, one of our interviewees was not familiar with the power of professional data. This is not uncommon, and where these articles come in: so, how should you go about optimizing your coworking rates with flex data?

Optimizing coworking rates with flex data

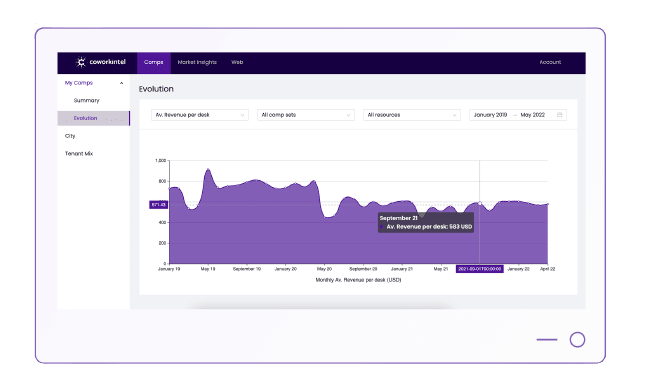

First, engaging with professional data means that you have a data-lead definition of your comp set to work with. Furthermore, with an understanding of supply, occupancy & rates across your competitive set, you can align your base rates to position yourself optimally. And, even better, you’ll have that visibility over the year ahead also, so you can always stay in line with demand and one step ahead of your competitors with proactive rate changes.

Imagine the following scenarios

- A prospective coworker wants to know your best price. Checking the dashboard, you see that the occupancy of your comp set flex desks is close to 100%, so you have the best, relevant availability in the market. You can factor this in when making a proposal, pushing a higher average desk rate across your stock.

- On the other hand, if your comp set occupancy is low, you could undercut their prices with one glance at your dashboard, and secure the occupancy.

- A coworker tenant is seeking a contract renewal. You don’t have professional data to check the pricing for your comp set but add a 10 per cent mark up as you see a neighbour has increased their rates. Your tenant moves to a similar space in the vicinity as your comp set pricing has actually reduced by 13%.

- You’re onboarding a new space and need to set pricing. An immediate understanding of competing spaces gives you a benchmark for your base prices.

Start optimizing coworking rates with flex data

It’s easy to get started - as operators you can simply connect your PMS by signing up here:

Get started with flex dataThis will give you access to many market metrics to begin visualizing your performance. If you prefer more headline data to start, you can also request a one-off city report here.