How do you go about maximizing flex occupancy with coworking data? As an operator, it’s important to have the information at your fingertips that will ensure that you win tenants over your competitors. Without flex data, there is no clear path to increasing your occupancy - connect to our data dashboard here for free, or read more below on how this business intelligence can maximize your occupancy.

- Tracking performance against targets and comp set

- Where is your occupancy falling down?

- Who is winning occupancy in your market?

- Optimizing rates

- Tenant mix & lead procurement

- Social/web performance

Tracking performance against targets & comp set

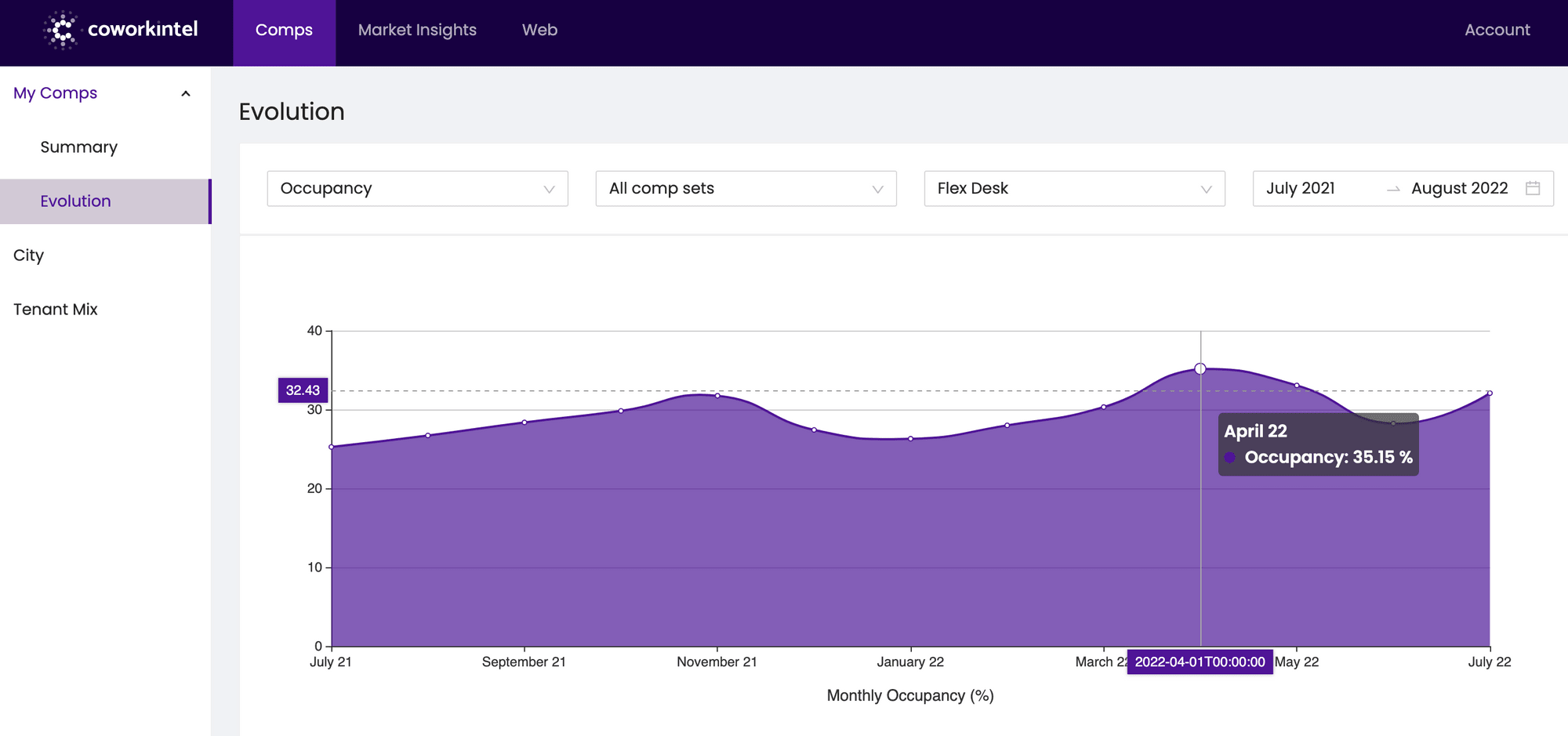

The first step in maximizing your coworking occupancy is understanding your occupancy and that of your market. This will allow you to set progressive, attainable targets across your spaces.

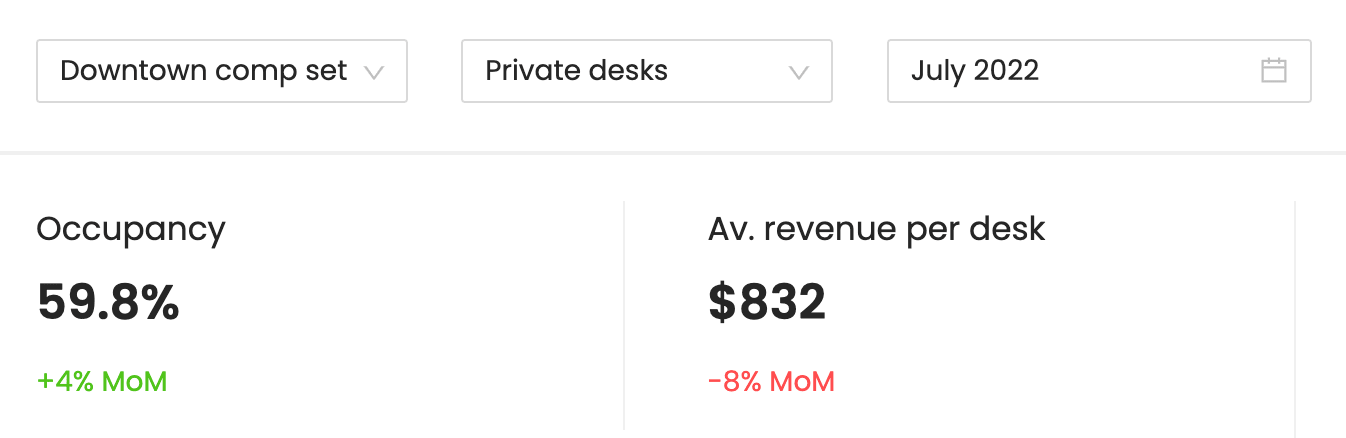

Following that, tracking the performance of your own spaces, both against your market and specific competitive sets, will allow you to act accordingly. Of course, occupancy is a key metric, but revenue per desk is also fundamental.

Furthermore, you can look more specifically at the various inventory types - team office, flex desk or private, but also other types of data to understand the restricting factors on your occupancy.

Who is winning the occupancy race in your market?

Some operators find it useful to identify key group of players and success stories in their markets. This makes it possible to analyze the pricing/occupancy data for your competitors (in an aggregated and anonymised way), but also the tenant mix, web and social strategy of those in your comp set, in order to refine your own strategy.

Where is your occupancy falling down?

Understanding your own occupancy within the context of your competitive set may be much easier with flex data, but identifying areas and methods for improvement is where flex data and analysis really comes into its own. Of course, half the battle with improving anything is understand where its limitations lie.

Overall occupancy may be down due to your rates, your lack of visibility, sales approaches, space/amenity provision, supply saturation or website for example. Digging a little deeper, you may find that occupancy within certain types of inventory is much lower/higher; maybe your flex desks are above average for occupancy in your market, yet private offices are sitting empty a little too often. Alternatively you may identify that contract lengths are much shorter and so desks have a greater proportion of dormant/transitional time.

The good news is, flex market intelligence can shine a light on all of these potential hurdles and also illuminate the fixes. Maybe you need to reduce your rates for private offices, spend a little more on marketing within a key demographic for your comp set, adjust your sales strategy to focus on linkedin or talk about a new pet-friendly policy? Or you could hold out for longer contract lengths, alter the proportion of flex:private desks in your space or adapt your website to speak to less corporate prospects.You can even monitor openings and closures in your vicinity and assess locales for growth. Whatever the answer is, finding it can be the key to much improved revenue, and coworking data can help you get there.

Maximizing flex occupancy with coworking data: Optimizing rates

A cornerstone to your occupancy achievements will be your rate strategy. Comprehending where you should be pitching a space in the context of its true competitive set - how it appears in a rank of options to potential tenants - will dictate how many people sign up.

It’s important to optimize your pricing depending on seasonality, contract length and of course desk type, but critically, also pricing across consumer choice.

This is where market rate data comes in.

Flexible workspace data: Tenant mix & procurement

One of the beauties of flexible workspaces is the melting pot of diverse professionals they can attract. From corporate company employees to self-employed individuals, start-ups or digital nomads - they all buy office space. As do a spectrum of demographics and also industries from finance to design. Gauging your own tenant mix, and that of the market, is important to your branding, provision and operations, and to your marketing and sales strategy. So learn who is occupying flex desks in your market - and also how you are procuring those who occupy yours.

Furthermore, data can help to identify professionals in your immediate area who may be in the market for those empty flex desks. If you could have a list of potential tenants situated locally, wouldn’t you?

Maximizing flex occupancy with coworking data: Social & web performance

Finally, you should consider how these potential tenants are being made of your space, and also how else they could be. Now of course this depends on your tenant mix, brand and provision - and funds - but social media and websites will be focal mouthpieces of any flex operation. Therefore it makes sense to gauge your efforts against your competitors. How many visits is your site seeing, how many followers do you have or interactions are you attracting per post?

Moreover, how is your competitive set faring in comparison? Who are the big hitters on social and what kinds of posts are boosting their presence? Who owns the powerhouse websites and why are they effective? All this information can assist you in building your visibility amongst prospective tenants.

Maximizing flex occupancy with coworking data

Ultimately there are many factors at play where flexible workspace occupancy is concerned. The factors within the control of operators, which can bring about some improvement to coworking occupancy, can be attributed to 3 main focuses:

- Pricing strategy (are your rates nuanced and proactive?)

- Visibility (who are your tenants and prospects and how are they aware of your coworking space?)

- Operations (how are you selling and operating your flexible workspace?)

Reacting to improve in these areas and stay competitive in a growing industry is crucial, but first, you need to get tracking and analyzing your performance - get started:

connect to your data dashboard here